The Great Rotation Playbook — Theme 2: Critical Minerals & The Mining Supply Cliff

The Manual of Ideas for Investing in the 3D World

This report builds on “The Great Rotation: The Case for Intelligent Investing 3D” and “The Great Rotation Playbook — Part 1: The Energy Backbone.”

The global financial system stands at the precipice of a regime change as significant as the dissolution of the Gold Standard in 1971 or the Dot-Com peak of 2000. As outlined in The Great Rotation, the last decade has been defined by the “2D World,” an ecosystem of bits, software, and infinite scalability. This era of near-zero marginal costs and asset-light business models generated unprecedented concentration in the S&P 500, particularly within the Mag 7. However, the economic logic underpinning this digital hegemony is fracturing.

We are witnessing the collision of two opposing forces: a deflationary supply shock in the digital realm driven by Generative AI, and an inflationary supply cliff in the physical “3D World” driven by capital starvation and geological entropy. Until very recently, the market has priced the 2D world for perfection, assuming margins will remain elevated indefinitely despite the commoditization of code and content, while pricing the 3D world for irreversible decline.

In Part 2 of The Great Rotation Playbook we articulate the investment case for the Metals & Mining sector as a primary beneficiary of this rotation. The thesis is not merely one of cyclical reversion but of structural necessity. The AI buildout is voraciously physical; it cannot exist without the copper for transmission, the nickel for storage, and the baseload power provided by uranium.

We draw upon the “Capital Starvation” frameworks of Massif Capital, the “Scarcity Investing” philosophy of Horizon Kinetics, and the “Anti-Carry” thesis of Goehring & Rozencwajg to demonstrate that the mining sector offers the most asymmetric risk/reward profile in modern markets. This is the metamorphosis of the Old Economy: from a despised cyclical trade to a strategic imperative.

The Macro Setup

The financial environment of the last decade was a “carry regime”, a period of low volatility and suppressed interest rates that incentivized leverage and long-duration assets (tech stocks) while punishing short-duration, real assets (commodities). Goehring & Rozencwajg argue this regime creates a feedback loop where capital flows blindly into the largest capitalized companies, creating a “suction pump effect” that starves the physical economy of investment.

The “carry bubble” is characterized by leverage-dependent, short-volatility trades that thrive when conditions remain steady. In such an environment, financial assets are pushed far above levels justified by the underlying economy, sometimes exceeding 200% of GDP. Natural resource equities, conversely, are typically ignored or used as a funding mechanism for the long side of the carry trade (i.e., investors short commodities to buy tech).

We are now transitioning to an “anti-carry” regime. In this environment, volatility rises, inflation becomes sticky (or “localized” in scarce assets), and the correlation between bonds and equities flips positive. History suggests that during anti-carry periods, such as the 1970s and the early 2000s, resource equities do not just outperform; they often become the only asset class to deliver positive real returns. Following the collapse of the 1970s carry bubble, oil and commodity stocks became the primary driver of returns, with oil companies eventually accounting for one-third of the S&P 500’s market capitalization. Currently, oil wealth makes up only 3% of the aggregate wealth of the Forbes 400, compared to 20% in 1982, suggesting room for mean reversion.

AI as a Physical Inflationary Force

A critical misunderstanding in the current consensus is the belief that AI is purely deflationary. While AI collapses the cost of digital labor (coding, writing, analysis), it is an inflationary shock to the physical supply chain.

Energy intensity: An AI query requires significantly more energy than a traditional search query. Training a single large AI model consumes gigawatt-hours of electricity.

Infrastructure density: AI data centers are massive industrial warehouses packed with silicon, copper, and steel. They require up to 4x the copper density of traditional server farms for power distribution, grounding, and connection. Goldman Sachs estimates that AI will drive a 165% increase in data center power demand by 2030.

Grid stress: The simultaneous electrification of transport (EVs) and intelligence (AI) is placing an impossible load on electrical grids. We are asking the grid to retire dispatchable fossil fuel power (coal/gas) while adding massive new loads from AI data centers, creating a “Greenflation” and “Tech-flation” dynamic.

The “2D World” is parasitic on the “3D World.” As the digital economy attempts to scale, it hits the hard constraints of physics and thermodynamics. This bottleneck transfers pricing power from the consumer of resources (Big Tech) to the producer of resources (Miners).

Capital Starvation Thesis

The physical economy has been starved of capital due to a long-term focus on technology and ESG mandates. Murray Stahl of Horizon Kinetics describes this as a “suction pump effect,” where investors crowd into “Tech Exceptionalism,” pulling capital out of the broader market and concentrating it into a handful of mega-caps.

The S&P 500 has become historically concentrated, with the IT sector (inclusive of Amazon, Meta, and Alphabet) comprising roughly one-half of the index’s market value. This concentration leaves passive investors exposed to a regime change. Meanwhile, mining and energy companies have been punished by shareholders demanding dividends over growth, leading to neglect of exploration and development.

This lack of investment has created a “coiled spring” of potential returns. The world has consumed the surplus capacity of the 3D world, and just as demand is inflecting upward driven by AI, supply is hitting a wall. This sets the stage for the “Great Rotation” of capital from overvalued 2D assets to undervalued 3D assets.

Copper

Copper is the most critical vector for the “Intelligent Investing 3D” thesis. It is the physical manifestation of the “supply cliff” argument.

Goldman Sachs and Massif Capital project a structural deficit that is mathematically impossible to close within the current investment cycle. It takes 10–25 years to bring a new tier-one copper mine from discovery to production; we are paying for the lack of exploration spend between 2012 and 2020. Existing major mines (e.g., Escondida in Chile) are suffering from declining ore grades, requiring more energy and capital just to maintain production.

2024–2025 has seen major supply shocks. The closure of First Quantum’s Cobre Panama mine and disruptions at Freeport’s Grasberg mine (mudflow incident) have removed significant tonnage from the market. Goldman Sachs revised its 2025 forecast from a surplus to a deficit following the Grasberg disaster.

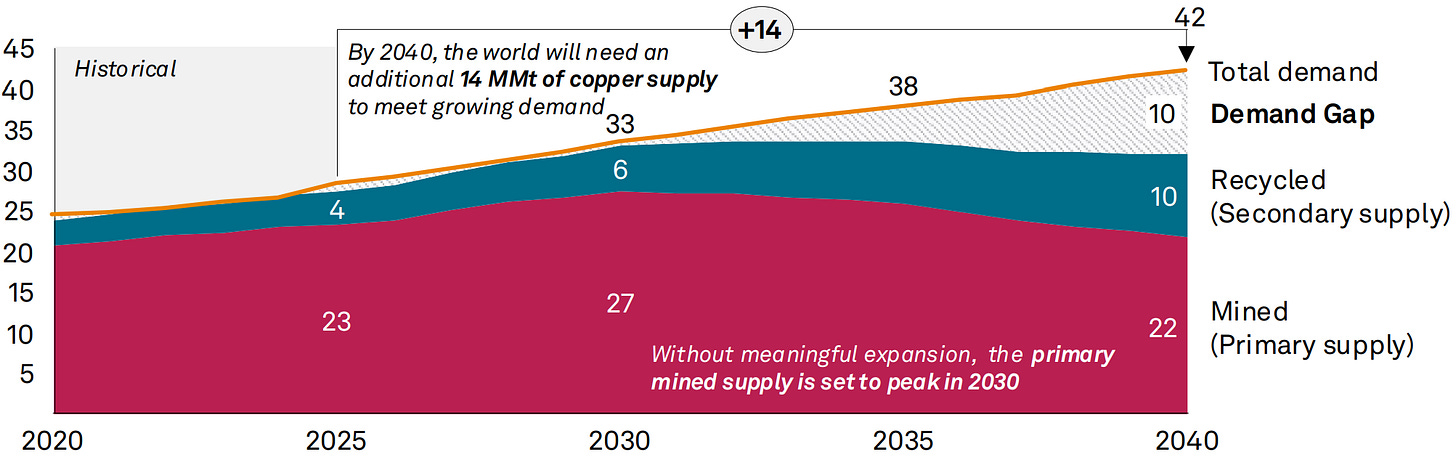

According to S&P Global, “Even as global demand is accelerating along these vectors, current supply is on course to decline as existing resources age. Without meaningful expansion of supply, the result could be a 10 million metric ton shortfall by 2040.”

Copper Market Balance, 2020-2040 (MMt Cu)

Goldman Sachs is even more bullish, as it forecasts a copper supply gap of up to 6 million tonnes as early as 2030, driven by the green and AI demand vectors. It projects copper prices to reach $15,000 per tonne by 2025. In this environment, the copper price is not just a function of GDP growth; it is a function of physical availability.

Let’s turn to actionable ideas.