Best Ideas Madrid 2025: Arcos Dorados, Delfi, Marex, Netcompany, Northeast Bank, UMG, and More

Highlights from inaugural MOI Global conference in Madrid

Special thanks to Javier López Bernardo, Ph.D., CFA, Portfolio Manager and Senior Investment Analyst at BrightGate Capital, for his pivotal role in organizing and hosting Best Ideas Madrid 2025. We are also grateful to Munesh Melwani, Founder and Managing Partner at Cross Capital, for his help in making the event a great success, and to Carlos Küster Sánchez-Cuervo, CFA, for his help in securing a central location.

What are the most compelling ideas for intelligent investors right now? Following insightful sessions at Latticework 2025 and European Investing Summit 2025, we continued our search at the first-ever Best Ideas Madrid summit, hosted by MOI Global on November 18.

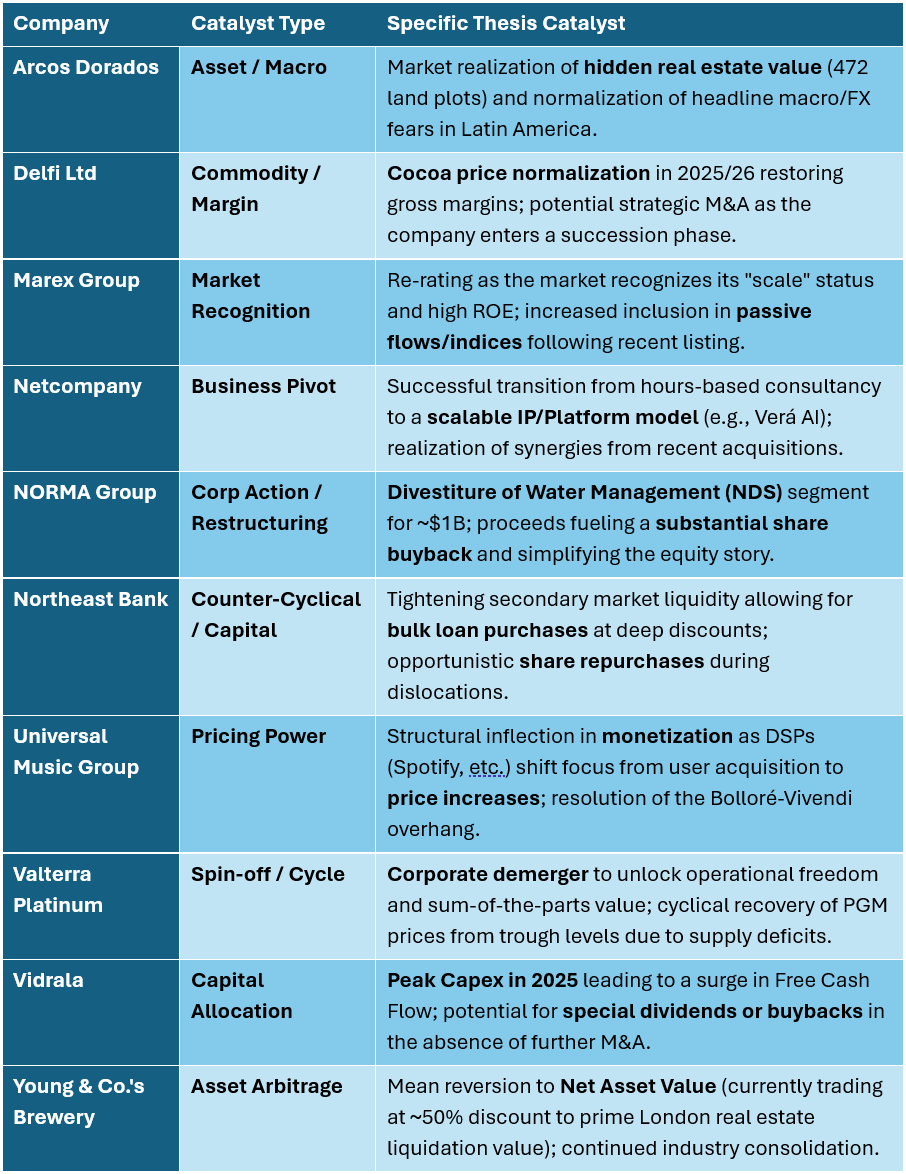

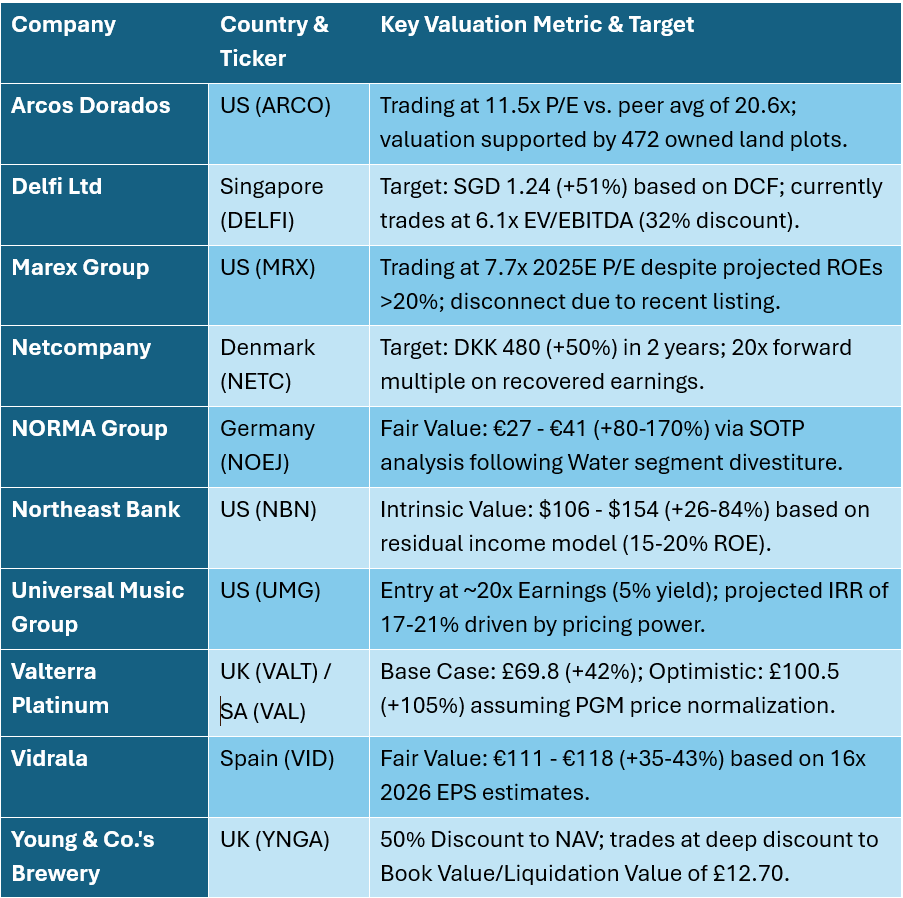

In an environment defined by concentration in mega-cap tech and passive flows, the hunt for alpha requires a divergence from the consensus. We were delighted to bring together a curated group of ten outstanding fund managers and analysts to present their high-conviction ideas. The recurring theme was not merely a compelling valuation, but the identification of idiosyncratic dynamics, including rational oligopolies, counter-cyclical compounders, and asset-backed dislocations.

A cluster of ideas focused on the resilience of tangible assets and hidden real estate value often obscured by accounting standards. Young & Co.’s Brewery (UK: YNGA) is an example of this dislocation, trading at a discount to the liquidation value of its prime London freehold estate. Similarly, Arcos Dorados (US: ARCO) is not just as a QSR play, but a mispriced collection of land plots masked by headline risks regarding LatAm forex volatility. In the commodities space, Valterra Platinum (UK: VALT) offers exposure to PGM supply deficits at the bottom of the mining cycle, with a pending demerger serving as the catalyst to unlock the sum-of-the-parts value.

The conference also featured businesses benefiting from rational industry consolidation and high barriers to entry. Universal Music Group (US: UMG) serves as a royalty on global audio consumption, leveraging its oligopolistic position to drive monetization in an era of content saturation. In the industrial sector, Vidrala (Spain: VID) demonstrates the power of logistical moats in the glass packaging industry, utilizing cash flows from its mature European operations to fund high-ROCE expansion in Brazil. Meanwhile, NORMA Group (Germany: NOEJ) is executing a “back to basics” turnaround, with smart shareholder involvement and a major divestiture set to dismantle the conglomerate discount.

Financials were approached through the lens of specialized niches and counter-cyclicality. Marex Group (US: MRX) capitalizes on the retreat of global banks from the Futures Commission Merchant space, using its scale to capture ROEs north of 20% amid heightened volatility. Northeast Bank (US: NBN) is a hybrid entity: a regulated bank with the DNA of an opportunistic credit fund, capable of generating outsized returns by providing liquidity in the secondary CRE market when traditional origination stalls.

Finally, the search for growth led to demographic and technological inflections. Delfi Ltd (Singapore: DELFI) offers a play on the Indonesian consumer class, currently trading at a cyclical low due to a cocoa supply shock that obscures its distribution moat. On the technology front, Netcompany (Denmark: NETC) is pivoting from a pure consultancy model to a scalable, IP-driven defense partner, capitalizing on the digitization of the European public sector.

The following summaries detail the specific valuation frameworks, catalysts, and risk assessments for these ten high-conviction ideas.

Let’s dive in.

Disclaimer

Best Ideas Madrid 2025 was held on November 18, 2025. The content of this website is not an offer to sell or the solicitation of an offer to buy any security. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment, or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information set forth on this website. BeyondProxy’s officers, directors, employees, and/or contributing authors may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated herein.

Arcos Dorados: McDonald’s Proxy with Emerging Market Growth and Hidden Real Estate Value

Amit Wadhwaney, Portfolio Manager and Co-Founding Partner at Moerus Capital Management, presented his investment thesis on Arcos Dorados (US: ARCO) at Best Ideas Madrid 2025.

Arcos Dorados operates as the largest independent McDonald’s franchisee globally and the master franchisee for the brand across Latin America and the Caribbean. With 2,457 stores, Amit identifies the company as the undisputed leader in the region’s QSR market, holding a market share position that is often double or triple that of its closest competitors in key geographies like Brazil, Argentina, and Chile. The business model is a mix of company-operated restaurants, sub-franchised outlets, and real estate ownership, which provides distinct competitive advantages regarding scale, supply chain integration, and access to the established McDonald’s ecosystem. While Brazil represents the largest market, accounting for 40% of sales, the company maintains a diverse footprint across the region with roughly 71% of its outlets being company-operated.

Investors frequently overlook the company’s underlying operational strength due to negative headlines regarding political instability and currency depreciation in Latin America. Amit argues that reported USD growth rates obscure robust local performance; for instance, while USD revenue grew at a 4.4% CAGR from 2015 through estimated 2025, revenue in Brazilian Reals expanded at a 9.6% CAGR over the same period. Similarly, local currency EBITDA growth has consistently outpaced USD-reported figures. This divergence masks a high-quality business that continues to grow purely on operational merit, characterized by increasing market share and QSR under-penetration in its core markets relative to developed economies.

Beyond the operating metrics, the balance sheet contains a hidden asset in the form of 472 owned land plots underlying its stores, which provides a tangible floor to value not fully appreciated by the market. While Amit acknowledges structural concerns—specifically a dual-class share structure that grants insiders voting control and the periodic requirement to renew the Master Franchise Agreement (recently renewed for another twenty-year term)—he believes the market excessively discounts these risks. He views the company as a partial ownership stake in a collection of attractive situations where the balance sheet is strong enough to ride out industry dislocations, fitting Moerus’s philosophy of prioritizing deep discounts to net asset value.

Valuation metrics suggest the stock is mispriced relative to both its intrinsic value and global peers. The shares recently traded at a trailing P/E of approximately 11.5x and an EV/EBITDA of 7.3x, a stark contrast to comparable McDonald’s master franchisees which trade at an average P/E of 20.6x. Global QSR peers similarly command higher multiples, with McDonald’s Corporation trading near 25x earnings and Indian franchisee Westlife Foodworld trading at triple-digit multiples. Amit contends that Arcos Dorados offers superior growth potential and brand positioning compared to these peers, yet trades at a deep discount due to temporary macro fears rather than long-term business fundamentals.

Scroll to the bottom to download the slide presentation.

Delfi Ltd: Capturing the Indonesian Consumer Growth Story

Munesh Melwani, Founder and Managing Partner at Cross Capital, presented his thesis on Delfi Ltd (Singapore: DELFI) at Best Ideas Madrid 2025.

Delfi is a leading Southeast Asian chocolate manufacturer with 40-50% market share in Indonesia. The company operates a portfolio of heritage brands, including SilverQueen and Ceres, which are tailored to local tropical taste preferences. A key advantage lies in Delfi’s extensive distribution network covering over 400,000 points of sale across 17,000 islands. This infrastructure utilizes a specialized cold-chain network that global competitors find difficult to replicate, creating a wide moat that protects market share across both modern retail channels and traditional “warungs.”

The thesis is underpinned by a structural consumption runway in Indonesia, where chocolate penetration remains under 0.4 kg per capita compared to 5-10 kg in developed markets. Favorable demographics, characterized by a young population and a rising middle class, support a long-term shift toward branded packaged foods. As disposable incomes rise and infrastructure improves, Delfi is positioned to capture both volume and value growth through its “affordable premium” positioning and operational leverage.

Recent financial performance has been impacted by a cyclical supply shock in the cocoa market, which drove prices to record highs and compressed gross margins. However, Munesh argues this creates a temporary dislocation for a high-quality business. With cocoa prices expected to normalize toward the $4,000-$5,000/t range in the 2025/26 period due to supply responses and weather improvements, the company is poised for margin repair. Management has also implemented pack-size adjustments and mix upgrades to mitigate input cost pressures in the interim.

Delfi operates a capital-light model requiring maintenance capex of less than 2.5% of sales, enabling consistent FCF generation. The balance sheet remains healthy with a net cash position, supporting a sustainable dividend policy with a historical payout ratio of approximately 50%. Munesh notes that management continues to focus on working capital improvements and disciplined cost control, which should drive ROIC back toward normalized levels of 10-11% as the commodity cycle stabilizes and margins expand.

Regarding valuation, the shares recently traded at SGD 0.82, representing a multiple of approximately 6.1x EV/EBITDA and 14.5x PE. Munesh points out that this valuation represents a 32% discount to regional peers and trades roughly 44% below the company’s own five-year historical average. Based on a DCF analysis assuming margin recovery and terminal growth of 3.5%, the presentation suggests a fair value of SGD 1.24, implying upside potential of 50-60%. With an estimated 2025 FCF yield exceeding 10%, the current entry point offers an asymmetric risk-reward profile.

Scroll to the bottom to download the slide presentation.

Marex: Niche Leader with High ROE and Growth at a Single-Digit Multiple

Daniel Gladiš, the founder of the VLTAVA Fund , presented his investment thesis on Marex Group (US: MRX) at Best Ideas Madrid 2025.

Marex is a diversified global financial services platform providing essential liquidity, market access, and infrastructure across energy, commodities, and financial markets. Daniel characterizes the company as a “scale” player possessing a genuine source of sustainable competitive advantage, distinct from the timing plays typical of small-cap financials. As a top-10 Futures Commission Merchant (FCM) in the US, Marex competes directly with large global banks but also capitalizes on their retreat from the sector due to legacy technology burdens and capital constraints. The company benefits from a consolidated landscape where the number of FCMs has declined by 53% since 2002, allowing it to service a full spectrum of clients through deep product expertise and 24/6 global reach.

The company has demonstrated a decade-long track record of profitability, delivering adjusted profit before tax (PBT) CAGR of ~35% from 2014 to 2024. This growth is underpinned by both secular drivers, such as the increasing demand for cleared derivatives, and near-term thematic trends like geopolitical unpredictability and asset class volatility. The revenue model is highly diversified and recurring, with clearing services and agency execution providing a stable baseline of client flow. Management anticipates a future growth mix of approximately 60% organic and 40% inorganic, supported by a history of value-accretive acquisitions such as ED&F Man Capital Markets and the prime brokerage business of Cowen.

Marex maintains a robust financial profile with an investment-grade credit rating and a balance sheet where roughly 80% of assets are driven by client activity. This structure consists largely of short-duration, highly liquid instruments, resulting in a modest corporate balance sheet and rapid asset turnover. Daniel notes the company’s exceptional cash generation, with adjusted FCF conversion consistently in the mid-90% range. This strong cash flow supports a disciplined capital allocation framework that funds organic expansion, selective M&A, and a progressive dividend policy, with the company recently paying a quarterly dividend of $0.14 per share.

The shares recently traded at approximately $30, a valuation that Daniel argues fails to reflect the quality and compounding potential of the business. At this price, Marex trades at a 2025E PE of 7.7x and a 2026E PE of 7.1x, despite projected ROEs remaining above 20% and EBIT margins expanding toward 22%. Daniel attributes this disconnect to the company’s short history on the stock exchange, its classification as a UK small-cap financial which falls outside many passive strategies, and the high barriers to entry that make it difficult for outsiders to assess the business quality. With a dividend yield expected to reach 2.0% in 2025, the current valuation offers a compelling entry point for a growing industry leader.

Scroll to the bottom to download the slide presentation.

Netcompany: From Consultancy to Strategic Defense Partner

Ole Soeberg, founder of Nordic Investment Partners, presented his thesis on Netcompany (Denmark: NETC) at Best Ideas Madrid 2025.

Netcompany is an IT services firm with approximately 10,000 employees, specializing in building and maintaining digital infrastructure for public and private sectors across Europe. Founded in 1999, the company has historically focused on delivering business-critical IT solutions, generating 42% of sales from Denmark and 34% from South East Europe and EU institutions. The operational model is transitioning from a traditional consultancy heavily reliant on billable hours—where programming previously accounted for 100% of delivery—toward a mix that emphasizes standardized components and reusable IP.

Ole highlights a pivotal shift from traditional “acquisitional hiring” toward “scalable IP” via the “Platforms for the Future” strategy. The objective is to evolve the delivery model to a structure where platforms account for 50% of the business, with vertical and customer-specific solutions making up the remainder. Central to this evolution are AI-enabled products such as Verá, a defense-oriented real-time awareness tool comparable to Palantir, and Easley AI, which streamlines compliance and system integration. Management projects the defense segment could eventually generate 20-30% of revenue.

Following a period where 2023 guidance presented a negative surprise, Ole suggests management may now be providing conservative estimates to rebuild credibility (”lowballing”). The company has issued long-term guidance for 2025 targeting 5-10% organic growth and a 20% EBITDA margin, aiming for group revenue to reach approximately DKK 11.6 billion by 2029. Financial risk remains moderate, with net debt/EBITDA at 2.1x. While AI-driven software development poses a threat to manual IT services, the introduction of proprietary AI tools is intended to mitigate this disruption.

The shares recently traded at DKK 320, implying a market capitalization of DKK 15 billion. Ole identifies a disconnect between the current valuation and the company’s growth potential relative to peers. Applying a 20x forward multiple, he outlines a target price of DKK 480 within two years, representing an annual return exceeding 20%. This valuation thesis relies on the successful commercialization of the platform strategy and the realization of synergy effects from recent acquisitions like SDC.

Scroll to the bottom to download the slide presentation.

NORMA Group: Margin Recovery and Major Buyback Catalyst

Nils Herzing, an Executive at Shareholder Value Beteiligungen AG (SVB) , presented his investment thesis on NORMA Group (Germany: NOEJ) at Best Ideas Madrid 2025.

NORMA Group is a global leader in engineered joining technology, offering specific clamp and connection solutions across Mobility, Industry Applications, and Water Management segments. Nils characterizes the core business as a manufacturer of mission-critical “C-components.” While these parts represent a negligible fraction of the total unit cost—often averaging €0.45 per unit—their failure can lead to catastrophic system breakdowns. This dynamic creates high customer stickiness, evidenced by the fact that NORMA acts as a single-source supplier in 90% of its Engineered Joining Technology business. The company manages high operational complexity with over 40,000 products, creating a defensive moat against competitors.

The investment case is predicated on a turnaround strategy following years of underperformance and margin compression. Nils highlights the involvement of activist investor Teleios Capital, which has built a 21% stake, as a driver for necessary governance changes. A refreshed management team, including a new CEO and Chairman, has been appointed to execute a “back to basics” strategy. This operational pivot aims to restore profitability in the core metal and plastic joining businesses, which had suffered from inefficiencies and a lack of focus.

A central catalyst for value realization is the strategic divestiture of the Water Management segment (NDS). Nils details the sale of NDS for $1 billion, a transaction that fundamentally alters the company’s capital structure. By selling this high-value asset at a premium multiple compared to the group’s trading valuation, management can unlock the “conglomerate discount.” This separation simplifies the equity story, leaving a focused industrial player with a cleaner balance sheet and substantial resources to reward shareholders.

Future returns are expected to be driven by rigorous capital allocation rather than aggressive top-line growth. The proceeds from the Water segment disposal provide the liquidity for substantial share buybacks, allowing the company to take advantage of the arbitrage between the private market value of its assets and its public trading price. Nils projects that even with modest organic growth in the remaining Mobility and Industry segments, the reduction in share count combined with margin recovery will drive a material increase in EPS and FCF per share.

Regarding valuation, the shares recently traded at an EV/EBIT multiple of approximately 6.6x, representing a discount to peers such as Stabilus and TI Fluid Systems. Nils presents a Sum-of-the-Parts (SOTP) analysis indicating that the intrinsic value is significantly higher than the recent share price. By factoring in the proceeds from the Water division sale and assuming a reduction in the share count to approximately 15 million shares via buybacks, Nils estimates a fair value per share between €27 and €41, offering a wide margin of safety compared to recent trading levels around €15.

Scroll to the bottom to download the slide presentation.

Northeast Bank: A Counter-Cyclical Compounder with “Outsider” CEO Hiding in the Banking Sector

Javier López Bernardo, Portfolio Manager (equities and high yield) at BrightGate Capital, presented his investment thesis on Northeast Bank (US: NBN) at Best Ideas Madrid 2025.

Northeast Bank is not a traditional lender but a hybrid entity combining a regulated bank charter with an opportunistic credit investment philosophy. Led by Rick Wayne, the management team boasts a multi-decade track record of compounding capital at approximately 20% rates. The bank operates with a distinct structural advantage: it utilizes low-cost deposits to fund the acquisition of commercial real estate (CRE) loans in the secondary market. This strategy allows NBN to act counter-cyclically, ramping up purchase volumes when secondary market liquidity dries up and traditional origination slows, while maintaining a low fixed-cost base due to the absence of a traditional branch network.

The thesis emphasizes the bank’s disciplined underwriting and credit standards. Despite an aggressive opportunistic acquisition strategy, the loans acquired by NBN over the last decade have incurred zero credit losses. The portfolio is characterized by seasoned loans with substantial equity cushions; the weighted average LTV was recently reported at 49%. This approach creates a margin of safety, as a substantial portion of the purchased portfolio consists of pre-2019 vintages where borrower incentives to default are minimal. Furthermore, the management team holds a substantial equity stake, ensuring strong alignment with shareholders and a focus on long-term value creation over short-term volume targets.

Operationally, NBN functions with an “accordion-like” balance sheet, expanding and contracting based on the attractiveness of the opportunity set. This flexibility was evident during the Paycheck Protection Program (PPP), where NBN was among the most active banks relative to its size, generating outsized ROEs reaching 36% in 2021. More recently, the bank utilized its capital to acquire a loan portfolio exceeding $1 billion in face value. The current efficiency levels, driven by the lean operating structure, position the bank to sustain ROEs in excess of 15% going forward, even as it digests recent growth and navigates the current interest rate environment.

Regarding valuation, the shares recently traded at a modest premium to book value and below 9x forward earnings, despite the bank’s historical outperformance against both the KRE index and larger peers. Based on a residual income valuation model assuming conservative growth and ROEs between 15% and 20%, the intrinsic value is estimated between $106 and $154 per share. This implies a perpetual return profile in the 12-15% range, excluding potential one-off value creation events such as strategic bulk acquisitions or opportunistic share repurchases during market dislocations.

Scroll to the bottom to download the slide presentation.

Universal Music Group: A Royalty on Global Audio Consumption

Tomás Maraver, the CIO of Nartex Capital, presented his investment thesis on Universal Music Group (US: UMG) at Best Ideas Madrid 2025.

UMG is the owner of the largest music catalog and the dominant player in a rational oligopoly where three majors control over 70% of the global market. While the market often fears that technology platforms like Spotify or TikTok will democratize music creation and erode the moats of major labels, Tomas argues the opposite occurs; extreme content saturation—with over 120,000 new tracks uploaded daily—shifts the bottleneck from production to attention. In this environment, UMG’s scale in A&R and global distribution becomes essential for artists to break through, evidenced by the company retaining the vast majority of top-performing albums and artists.

The business model benefits from the structural shift to streaming, providing a long tail of recurring revenue with consistent EBITDA margins exceeding 20%. Tomas identifies two distinct growth levers: subscriber volume and a structural inflection in pricing power. Despite high engagement, music remains fundamentally under-monetized compared to the CD era, generating far less revenue per hour of consumption than video or gaming. With streaming penetration still below 40% in developed markets and DSPs shifting focus from user acquisition to price increases, UMG acts as a royalty on a growing user base that is increasingly willing to pay more.

Regarding the relationship with DSPs, the thesis posits that platforms need labels more than labels need platforms, as user loyalty resides with the artists and repertoire rather than the interface. Evidence of this power balance appears in contract structures, which include “Most Favored Nation” clauses and prohibitions on DSPs generating their own IP. Furthermore, Tomas addresses concerns regarding AI, noting that AI-generated music currently infringes on copyrights and that the industry has aligned to protect human artistry through defensive contract restructuring, ensuring major labels remain the primary gatekeepers of monetizable content.

The shares recently traded at an attractive valuation due to short-term dislocations, including an overhang from the Bollore-Vivendi dispute and liquidity constraints despite the company’s large capitalization. Tomas highlights an entry point around 20x earnings, offering an approximate 5% earnings yield against a backdrop of 10% expected EPS growth. With capital-light catalog assets comprising the majority of revenue and operating leverage driving margin expansion, the thesis projects returns could reach 17-21% over a three-to-five-year horizon as the multiple re-rates to reflect the quality and durability of the underlying cash flows.

Scroll to the bottom to download the slide presentation.

Valterra Platinum: Best-in-Class Producer Unlocking Value Through Demerger

Santiago Domingo Cebrián, an investment analyst at Magallanes Value Investors, presented his investment thesis on Valterra Platinum (UK: VALT, South Africa: VAL) at Best Ideas Madrid 2025.

Valterra Platinum is the world’s leading producer of Platinum Group Metals (PGM), currently commanding a one-third market share in platinum. The company operates as a fully integrated entity, managing the entire value chain from extraction to market distribution. Its operations are characterized by best-in-class assets defined by large scale, long mine life, and a low-cost structure. The sheer size of the resource base and the substantial capital investment required to replicate these operations create formidable barriers to entry for potential competitors.

The thesis is underpinned by favorable PGM supply and demand dynamics, particularly for platinum, palladium, and rhodium. Demand remains robust, driven by auto catalysts which account for over 70% of usage. Future consumption is supported by the increasing prevalence of hybrid vehicles, which require higher PGM loadings than internal combustion engines, as well as stricter emissions regulations. Additionally, the emerging hydrogen economy drives demand for iridium. Conversely, the supply side—heavily concentrated in South Africa—is constrained. The industry is navigating the bottom of the cycle, where low prices have led to losses and restructuring, resulting in inventory reductions and projected deficits.

Santiago highlights a specific corporate event as a key catalyst: a demerger designed to unlock operational freedom for Valterra. This spin-off narrative positions the company as an overlooked opportunity within the market. Despite the niche nature of the sector, Valterra benefits from the stability of a major producer rather than the speculative risks associated with junior miners. The combination of legal stability, high asset quality, and a strong balance sheet provides resilience while the market potentially misprices the equity following the corporate restructuring.

Regarding valuation, Valterra shares recently traded at £49.1. Santiago outlines a scenario analysis suggesting an asymmetric risk-reward profile. Under a pessimistic scenario using spot PGM prices, the downside is estimated at approximately 5%, with a fair value of £46.5. However, a base case assuming normalized commodity prices suggests a value of £69.8, representing an upside of roughly 42%. In an optimistic scenario characterized by “blue-sky” pricing, the valuation could reach £100.5, implying potential appreciation of 105% from recent levels.

Scroll to the bottom to download the slide presentation.

Vidrala: A Compounder with European Stability and Brazilian Growth

Pablo González, CEO and founder of Abaco Capital, presented his investment thesis on Vidrala (Spain: VID) at Best Ideas Madrid 2025.

Vidrala is a leading consumer packaging company focused on sustainable glass solutions, operating nine plants and two beverage filling facilities across Iberia, the UK, and Brazil. The industry is characterized by high barriers to entry due to the capital-intensive nature of continuous 24/7 production and the logistical constraints of glass, which limit competitive radii to approximately 500 kilometers. Pablo notes that these dynamics create a consolidated market structure where scale efficiency, local presence, and proximity to clients drive profitability. The company holds strong market positions in its core geographies, with Vidrala and Veralia collectively dominating the rational and consolidated Iberian market.

The business splits into two distinct profiles: the mature, cash-generative European operations and the high-growth Brazilian segment. Iberia and the UK represent about 80% of EBITDA, operating in stable environments with cost advantages derived from lower labor costs and geographic insularity. Conversely, Brazil, representing 20% of EBITDA, serves as the growth engine, driven by favorable demographics and beer consumption trends. Pablo highlights the recent acquisition of a profitable local player in Brazil as a platform for organic expansion and further consolidation in South America, leveraging operational synergies to drive returns.

Management boasts a long record of value creation, delivering 11% sales and 12% EBITDA CAGRs since 2001, with ROCEs consistently exceeding 12%. This performance is underpinned by a strategy of reinvesting ~12% of sales back into the industrial footprint—well above the industry maintenance level of 6-7%—ensuring a modern, cost-competitive asset base. The company maintains a conservative balance sheet with leverage expected to drop to 0.3x Net Debt/EBITDA by 2025. This financial flexibility supports a capital allocation policy combining organic investment, accretive M&A, and consistent shareholder returns via dividends and buybacks.

Vidrala shares recently traded near €82, implying a valuation that discounts its historical quality and growth prospects. Pablo forecasts 2026 EPS between €6.95 and €7.39. Applying a historical average P/E of 16x to these estimates yields a value per share ranging from €111 to €118, offering attractive upside. Furthermore, recent sector M&A activity has taken place at multiples around 7x EV/EBITDA, while Vidrala enters a period of enhanced financial flexibility with major capex cycles peaking in 2025. In the absence of large acquisitions, management is expected to consider special shareholder distributions or additional buyback programs.

Scroll to the bottom to download the slide presentation.

Young & Co.’s Brewery: Best-in-Class Margins at a Discount to NAV

Pedro Ordoñez, a buy-side equity analyst at Azvalor Asset Management, presented his investment thesis on Young & Co.’s Brewery (UK: YNGA) at Best Ideas Madrid 2025.